Payroll System: Thesis Documentation Chapter One

Introduction

The purpose of SDSSU Payroll System is mainly to provide automation to the SDSSU accounting section. The categories of this system where the accountant can calculate the amount an employee owe based on factors such as the time they worked, their hourly wages or salaries, and whether they took vacation or holiday time during the pay period. The system adjusts gross pay by calculating and subtracting taxes and other withholding amounts. This system was designed for convenience, less time cost.

According to Kenan Kalagho (2013) writer of Busineess Weeks in Dar Es Salaam, Tanzania the Payroll System saves Tanzania’s Government $927 Million. The government is currently saving some $927 million (Tsh1.5 billion) after introducing a new payroll system.

The proponents developed SDSSU Payroll System based in admin solution used to simultaneously track their employee information .The importance of this system in the establishment is that all the record and information in different department and offices well gathered by the admin. The researchers well provide to input their details to the admin all the staff in SDSSU Cantilan Campus. This will give detailed information for the staff or employees of the accounting section. Through this system the records of the staff or employees is easily and orderly organized, systematic and manageable they can see each of theme their detailed information about their own records.

A manual payroll system typically requires a great deal of paperwork. And manual process also creates an administrative burden for you and your HR staff. The payroll system represents an accounting or finance function business owners use to pay employees for their labor. Payroll systems can be internal or external, depending on the business owner’s knowledge and experience.

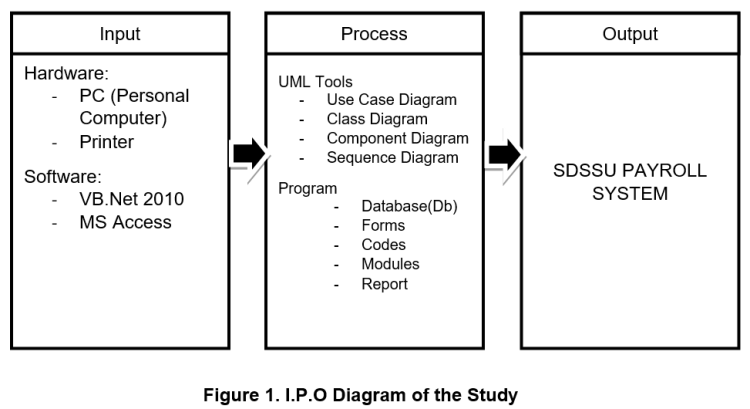

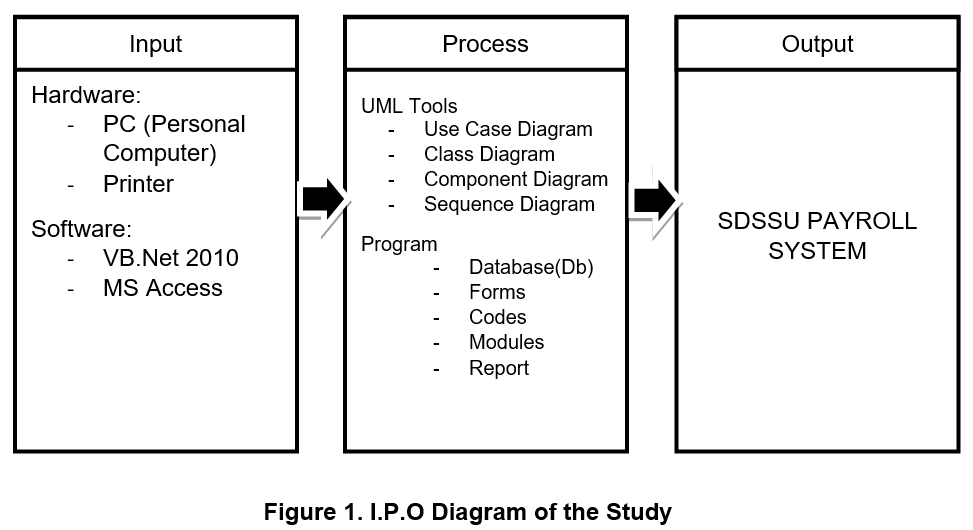

Conceptual Framework of the Study

Figure 1.Shows the conceptual framework which illustrates the requirement and processes to develop a payroll system. The first box of the diagram state the requirements needed to develop the system. It is divided into 2 parts; Hardware and Software. The Hardware composes of PC (Personal Computer) and Printer, the other part is the Software, it is composing of VB.Net 2010 with embedded database using MS Access and making this system, Researcher Used PC (Personal Computer), Printer and VB.net 2010 operating system is recommended. This system used to create an presentable and functional SDSSU Payroll System. To complete this system researchers provide the process steps in manual SDSSU Payroll System. So it will be hassle free to the accounting section on finding employee information and generating pay-slip and general payroll, by using the PC (Personal Computer) stated above and providing the process of the possible transactions of employee and accountant researchers, complete the SDSSU Payroll System.

General objective of the study

To ease the payroll needs like registering, keeping track of payments and updating employee information etc, the payroll software plays a very important role. One of the benefits of using payroll software is that its total life-cycle cost is much lower and managing the time, work efficiency, size of the organization is done effectively.

Objectives of the study

The proposal aims to create a system that could provide the necessary database for all the payroll records and the system’s expected storage consumption. Second, it also involves fast, accurate and seamless computation of salaries of all the current employees of the expected client. This is to make the system more user-friendly, secure and unbiased by any external reasons. Lastly, to create a system that will be able to generate reports of all payroll transactions. In conclusion, this proposal must be able to meet all the characteristics a standard, non-faulty and expandable system has.

Specifically it aims to:

- To develop a system that will improve the SDSSU process in the Payroll.

- To prepare detailed salary record of all the employees in an organization.

- To develop a payroll system that can calculate and run monthly payroll.

- To Maintain Employee Details.

- To generate general payroll and salary slips.

- To backup and secure database in case of data loss.

Scope and Limitation

The proposed system covers many aspects of payroll process. This includes the capture of information based on the employee`s work schedule, daily time worked and daily time rendered. The payroll process encompasses all activities necessary to report employees time worked. The system will convert the current company`s payroll into visual basic program.

The proposed system provides fast and general report weekly and monthly in terms of their information and the transaction of their employers in the admin. The payroll system includes storing of information based on the employees work schedule daily time worked and daily rendered. The payroll process encompasses all activities necessary to report employees’ time work. This system provides user friendly interface in each every usability features of the system. The system helps tracking records of the employers in the SDSSU Cantilan Campus.

Significance of the study

The PAYROLL SYSTEM within Surgiaodel Sur state University is primarily focused on the staff and personnel’s salaries, taxations, etc. The system’s processes accuracy and legitimacy.

- Employees they will find it easier to transact about their records since searching in the system is faster than tracking in the record book or log book.

- Accountant will able to manage employee services, hours, pay rates it also includes elimination of time cards and unauthorized overtimes.

- Future researchers the proponents will gain knowledge about the system existing inside the administrative office, with this; skills in the system analysis will be improved and also it helps the future researcher to have an idea about payroll system and develop their own system. They can learn about the proponents system and at the same time develop a greater system with the help of the proponent study.

Definition of terms

Basic Pay – This refers to monthly rate divided by the number of working days multiplied by number of days worked.

Overtime hours – is the amount of time someone works beyond normal working hours. Normal hours may be determined in several ways.

Database – This refers to a organized collection of data for one or more purposes, it is usually digital form.

Deduction – This refers to business expenses or losses which are legally permitted to be subtracted from the gross revenue of a firm in computing its taxable income.

Employee – This refers to a person who is hired to provided services to accompany on a regular basis in exchange for compensation.

Gross Pay – This refers to total of an employee`s regular remuneration including allowances, overtime pay, commissions and bonuses, etc. before any deductions are made.

Loan –This refers to funds transferred from one party to another as payment purchased goods of services.

Net Pay – This refers to the remaining amount of an employee`s gross pay, after deductions, such as taxes and retirement contributions, are made.

Payroll – This refers to a sum of all financial records of salaries for an employee, wages, bonuses and deductions. In accounting, payroll refers to the amount paid to employees for services they provided during certain period of time

Payslip – This refers to a detailed breakdown on how much an employee is paid during a specific period.

Salary – This refers to wages received on a regular basis, usually weekly bi-weekly or monthly.

To download the source code of this thesis, visit Payroll System (SDSSU) Cantilan Campus (Visual Basic 2010 Ultimate with Embeded Database Microsoft Access)

Add new comment

- 6920 views